Have you ever heard of the term "hometown tax"?

Furusato nozei is a system whereby donations of over 2,000 yen to any local government can be used to deduct individual resident and income taxes. The system was originally established in 2008 during the first Abe administration as a new initiative to promote the correction of disparities in tax revenues between regions and for local governments struggling with declining tax revenues due to depopulation and other factors. In the 2011 Great East Japan Earthquake, many people made donations to support the disaster-stricken areas, and 64,914,900,000 yen was raised, about 10 times the amount from the previous year.

Recently, the term "hometown tax" has been widely featured on television and in magazines, so opportunities to hear it have increased, but there are probably many people who don't know much about it.

Now, let us briefly introduce the features of this "Hometown Tax" system.

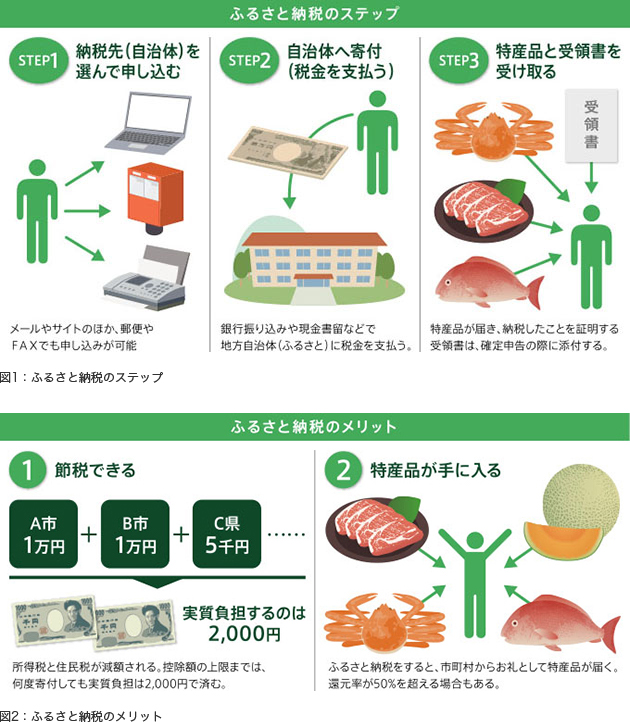

First of all, although the name says "tax payment," it is actually a type of donation deduction. It is a system that allows individuals to receive a certain amount of deduction from their resident tax and income tax when they donate more than 2,000 yen to any local government (prefecture, city, town, or village) in the country. In other words, in effect, part of the prefectural and municipal taxes that you currently pay will be transferred to the local government to which you donated.

Although it is called "Hometown," it does not have to be your hometown or place of residence, and you can donate freely to the local government you want to support. Many local governments also allow you to choose how your donations are used. For example, in addition to "supporting reconstruction efforts," which many people did after the Great East Japan Earthquake, you can also donate to policies or events that resonate with you, such as "I want to protect the natural environment of the local government where I lived during my university days" or "I want to protect and nurture the traditions and culture of my hometown."

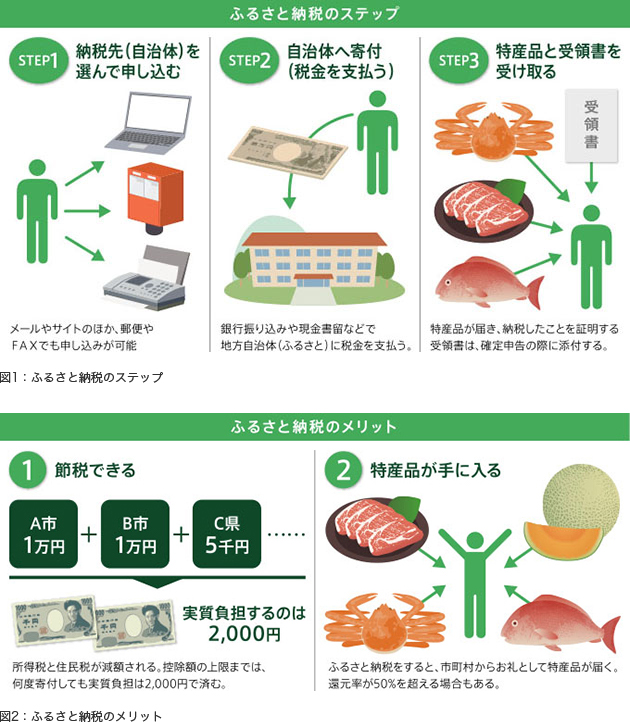

Many local governments also offer special gifts such as local specialty products and folk crafts to those who make hometown tax donations. One of the great attractions of hometown tax donations is that you can donate to a city or village that has a specialty product that you want. (Figures 1 and 2)

In the fiscal year 2013 taxation (covering donations made in 2012), hometown tax donations have increased compared to the year before the Great East Japan Earthquake, and it is believed that the popularity of local specialty products has led to a further increase over the past one or two years. With this popularity as a backdrop, the Abe administration, which has made "regional revitalization" a key issue, has raised the upper limit of the hometown tax deduction this year and expanded the system.